Bitcoin And Stock Market Correlation - Institutional Adoption?

Recently I’ve noticed that BTC has been following S&P 500 quite closely. Of course, there’s still a lot more volatility associated with cryptocurrencies than the broader stock market, but there seems to be a general trend whereby Bitcoin and S&P 500 seem to move in tandem.

When researching this, I found a lot of articles reporting different correlation coefficients between US equities and Bitcoin. Some were outdated. Some actually reporting inverse correlations. So I decided to run the calculations myself, and I found that the correlation coefficient of the S&P 500 and bitcoin, from July 2010 till today, is 8.7%. Quite interesting. However, this is far from the full picture.

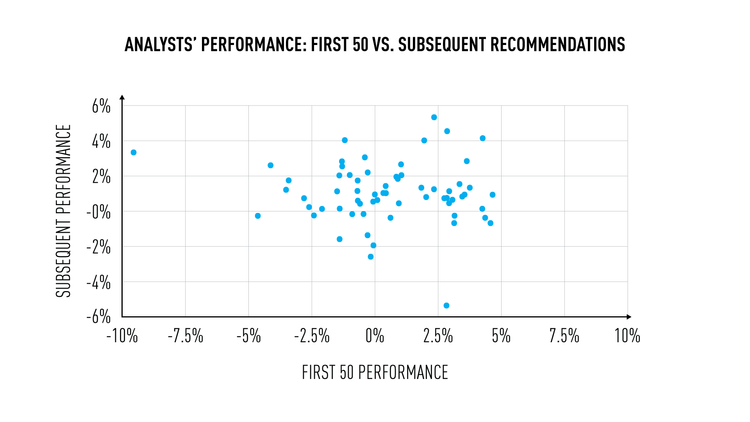

Next, I decided to calculate one year rolling correlations. Here’s what that looks like:

Bitcoin just recently had it’s highest ever 1 year rolling correlation with the S&P 500, at a whopping 44.3% correlation. One possible explanations is that that traditional institutions are starting to adopt bitcoin. However, we only have to go back 2 years to see the lowest (most inverse) correlation. In December of 2020, the rolling 1-year correlation coefficient of the S&P 500 and bitcoin hit -29.3%.

In December of 2020, Bitcoin also happened to have dropped 50% from it high a few months prior. It’s of course not a coincidence that bitcoin’s most inverse correlation with the S&P 500 was during a bitcoin crash. But let’s analyze further, and map bitcoin- and S&P 500 crashes/corrections:

This reveals a very interesting phenomenon. When the S&P 500 is dipping, it usually takes bitcoin down with it (correlation is high). But when Bitcoin crashes, it can do so completely without impacting the S&P 500 (correlation is low or even inverse). This is precisely the common price pattern of speculative assets. This means that the recent all time high in one year rolling correlations may in fact be explainable by the recent S&P 500 correction.

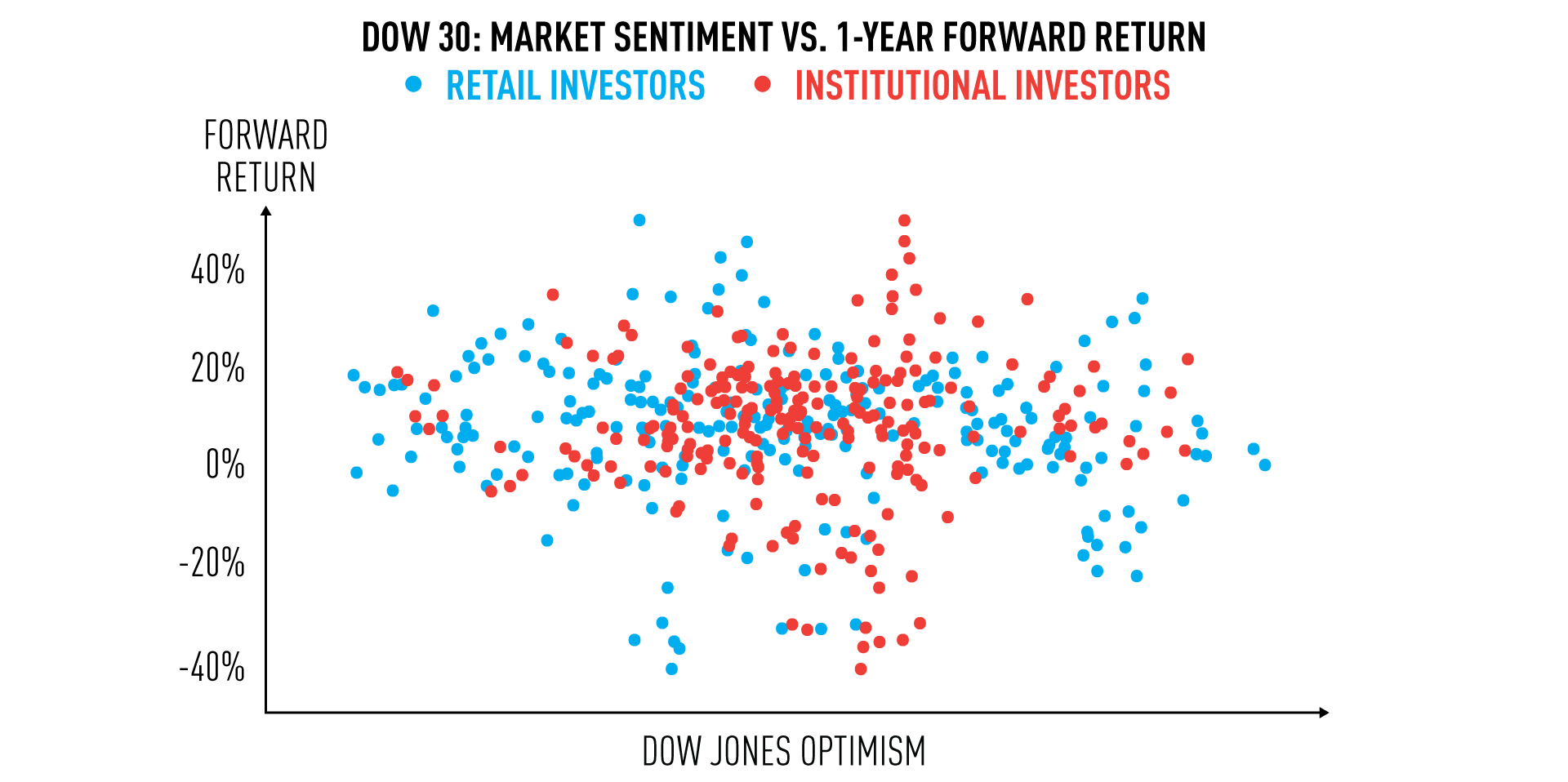

I also calculated the correlations between bitcoin and other assets:

| S&P 500 | Gold | MSCI | ARKK | TSLA | |

|---|---|---|---|---|---|

| Long-term correlation with bitcoin | 8.71% | 12.78% | 7.06% | 20.19% | 7.22% |

| Past year correlation with bitcoin | 36.10% | 13.84% | 7.67% | 37.65% | 35.96% |

In all cases, Bitcoin has been more correlated in the past year. In my opinion, this indicates that Bitcoin has been adopted as yet another possible asset to diversify your portfolio with.

Conclusion:

Adoption of bitcoin by traditional institutions seem to be increasing, but bitcoin still shows patterns of speculative assets.